100% Equity Financing

Large Assets & Projects - without debt

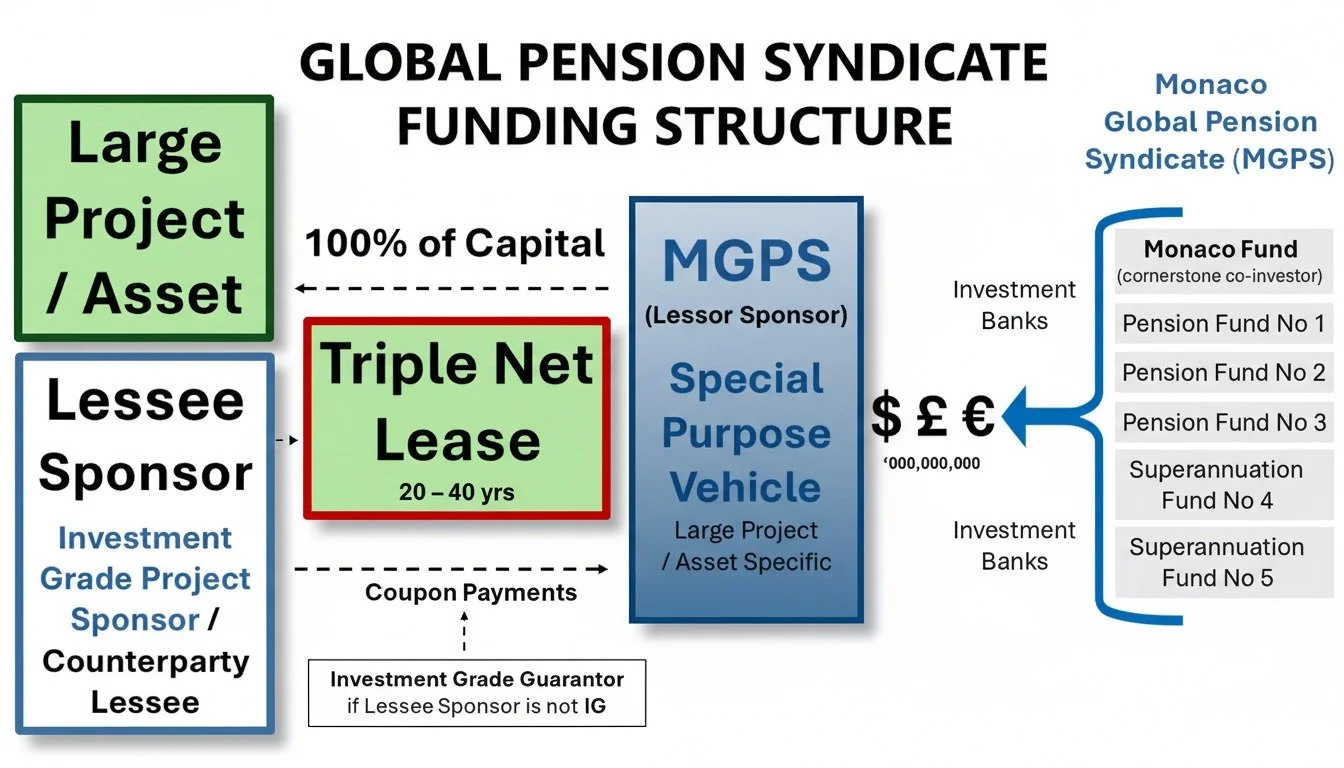

Asset Financing

New Project Funding

Asset Sale & Leaseback

Triple Net Lease Structure

Fixed 20–40 year term with CPI-linked annual adjustments

Lessee Sponsor is contractually responsible for all taxes, insurance, maintenance, and operations

Lease payments combine a fixed yield component and principal amortization

Lessee Sponsor accrues 50% beneficial ownership over the term, with an agreed buyout mechanism for the remaining equity at inception

Investment Grade

Under our funding model, the Lessee Sponsor or its guarantor must hold an investment grade rating from S&P or Moody’s to meet the strict credit requirements of global pension funds and institutional investors. This ensures that lease payment obligations are backed by a financially sound counterparty with a very low probability of default over the 20–40 year lease term.

Using only S&P and Moody’s ratings creates a consistent, internationally recognized benchmark for credit quality, aligning with institutional standards worldwide.

Syndicate Policy on Disclosure & Attribution

It is standard international practice and a foundational element of the syndication framework that only institutional investors with majority economic exposure are entitled to public attribution and recognition. Minor co-investors, particularly private entities, are contractually prohibited from disclosing or promoting their participation in such transactions, as any public claim to involvement would distort the perception of funding responsibility and undermine the accountability and integrity of publicly sourced capital. In this context, where public pension funds constitute the overwhelming share of investment (as is always the case in each MGPS), it is impermissible for private minority investors to seek visibility or credit, ensuring that recognition aligns with and preserves the public trust inherent in taxpayer-supported investments.